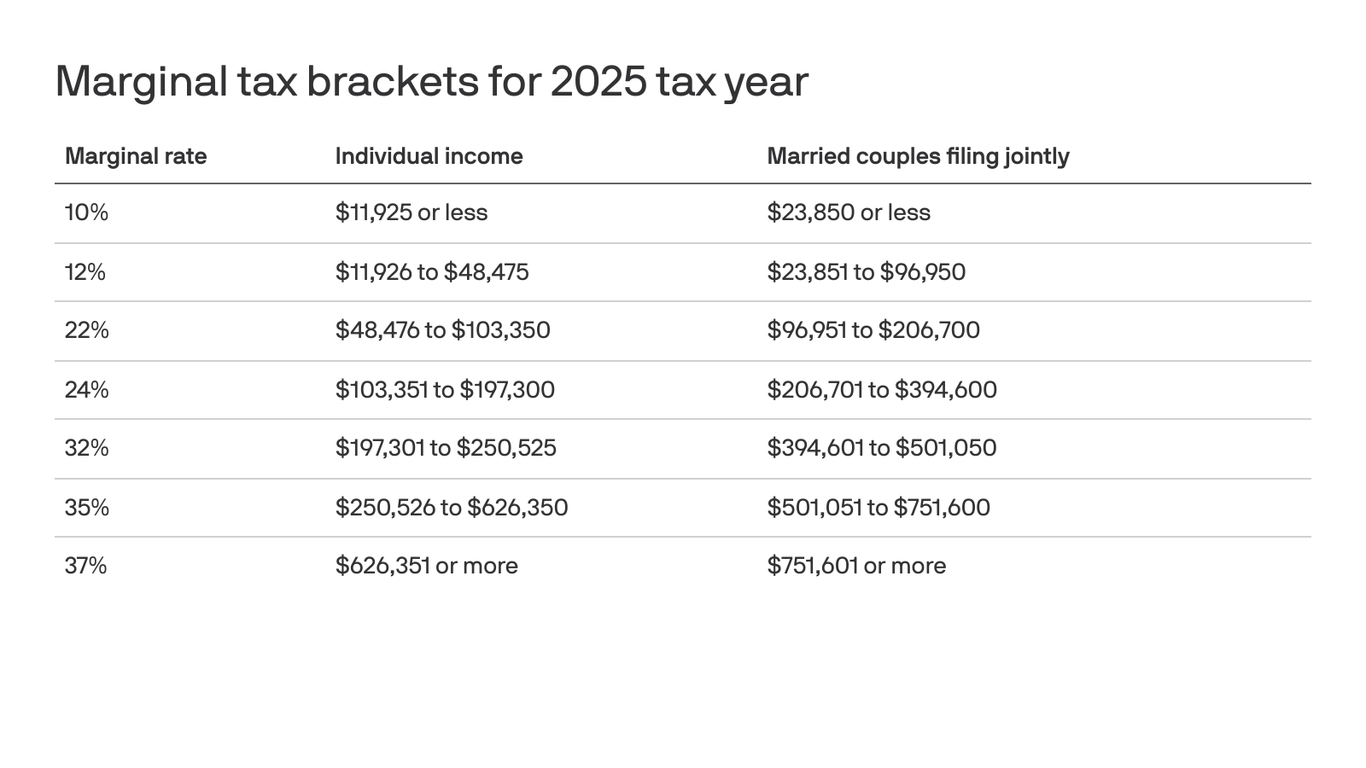

2025 Tax Brackets Table Irs. Since inflation is currently lower than in previous years, the adjustments for inflation will increase tax brackets by about 2.8% for 2025. In 2025, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1).

The irs has announced new tax brackets for the 2025 tax year, for taxes you’ll file in april 2026 — or october 2026 if you file an extension. The federal income tax has seven tax rates in 2025:

IRS 2025 Tax Rates A Comprehensive Guide To Projected Tax Brackets And, A common misconception is that when you get into a higher tax bracket, all your income is taxed at the higher rate and you’re better off not having the extra income.

2025 IRS Tax Tables A Comprehensive Guide Cruise Around The World 2025, A handful of tax provisions, including the standard deduction and tax brackets, will see new limits and.

Tax Bracket 2025 Irs Chart Mary Hemmings, We will review the most notable changes for 2025, from tax rates and deductions to credits and retirement contribution limits.

2025 Tax Brackets For Married Filing Jointly Beginning Of Ramadan 2025, The federal income tax has seven tax rates in 2025:

In 2025 Sam Churchill, We will review the most notable changes for 2025, from tax rates and deductions to credits and retirement contribution limits.

2025 tax brackets IRS releases inflation adjustments, standard deduction, We will review the most notable changes for 2025, from tax rates and deductions to credits and retirement contribution limits.

2025 Tax Brackets And Standard Deduction Chloe Delcina, Dependents benefit from a unique calculation that protects their earnings, while seniors receive higher deductions to account for increased living expenses.