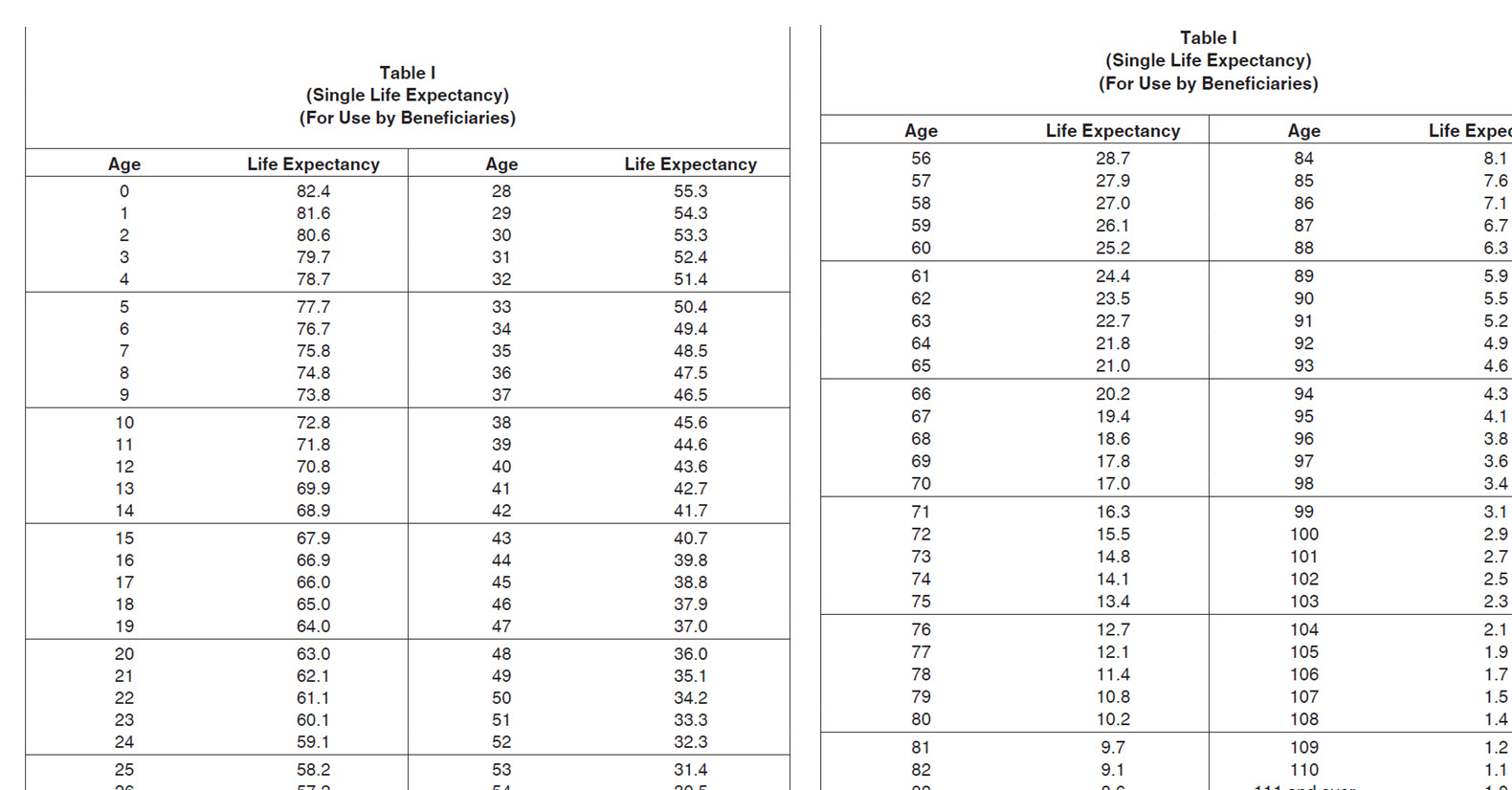

Inherited Ira Rmd Rules 2025 Married Filing. How to avoid losing an inherited ira and gaining a big tax bill. Distribute over spouse’s life using table i*.

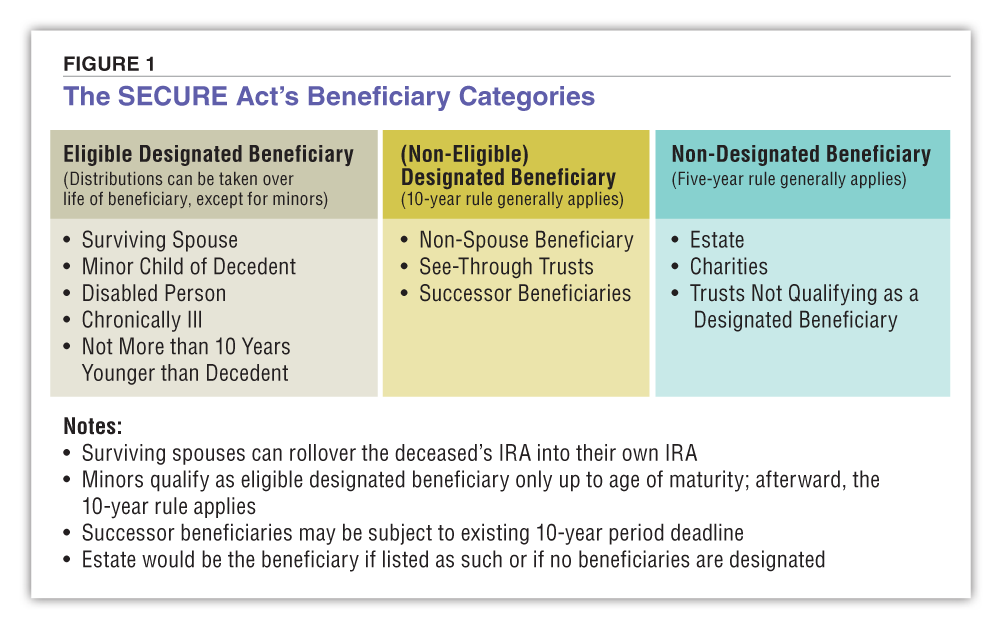

I am a spouse beneficiary of the original ira owner. Before 2025, if you inherited an ira and you were a designated beneficiary, you could do what was called a stretch ira, or an extended deferral, and take.

Rmd Table 2025 Inherited Ira Marlo Shantee, Distribute over spouse’s life using table i*. How to avoid losing an inherited ira and gaining a big tax bill.

Inherited Roth Ira Rmd Rules 2025 Chris Delcine, Before 2025, if you inherited an ira and you were a designated beneficiary, you could do what was called a stretch ira, or an extended deferral, and take. The irs seems committed to offering future.

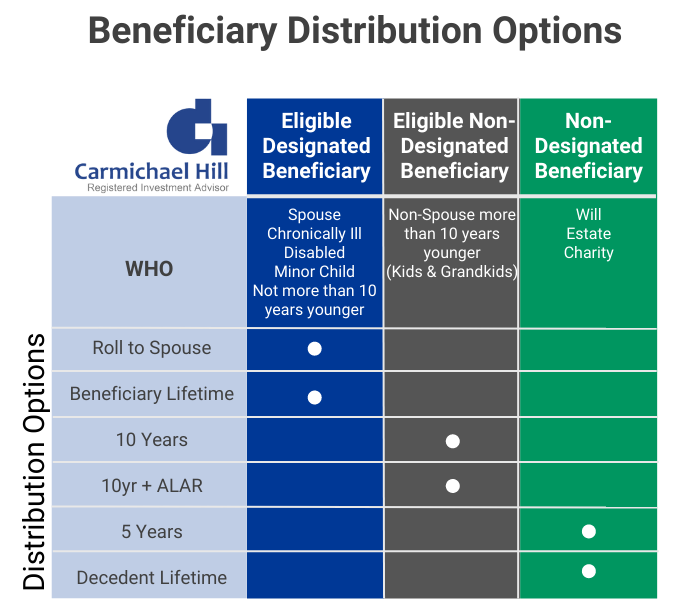

New Rules For Inherited Iras 2025 Merl Stormy, A beneficiary is generally any. Spouse may treat as his/her own, or.

New Inherited Ira Rules 2025 Donna Gayleen, This is the fourth year in a row that the irs. If you inherit an ira, you’ll need to follow certain rules carefully about how you manage and withdraw from your new account.

2025 Rmd Calculator Inherited Ira Marjy Shannen, When you inherit an ira or roth ira, many of the irs rules for required minimum distributions (rmds) still apply. This is the fourth year in a row that the irs.

Inherited Roth Ira Rmd Rules 2025 Chris Delcine, Distribute over spouse’s life using table i*. I am a spouse beneficiary of the original ira owner.

Inherited Roth Ira Distribution Rules 2025 Abbey, When you inherit an ira or roth ira, many of the irs rules for required minimum distributions (rmds) still apply. Whether or not this makes sense for you depends on the type of ira you have.

Inherited Ira Rules 2025 Perla Kristien, The irs seems committed to offering future. Fail to draw down the account in a way the irs.

Inherited Roth Ira Rmd Rules 2025 Chris Delcine, When you inherit an ira or roth ira, many of the irs rules for required minimum distributions (rmds) still apply. Under the secure act, certain heirs must empty.

Successor Beneficiary RMDs After Inherited IRA Beneficiary Passes, I am a spouse beneficiary of the original ira owner. Inheriting an ira comes with tax implications.

If you inherit an ira, you’ll need to follow certain rules carefully about how you manage and withdraw from your new account.

If you inherited an ira from someone who died before january 1, 2025, you can still use the old rules which allowed rmds based on the age of the beneficiary.